I’m younger than that now

Posted on Friday, March 29, 2019

Posted on Friday, March 29, 2019We usually associate ‘high tech’ with youth since the young are perceived – often correctly – of being faster to adopt new technology. The tech boom has been devastating for believers in the maxim “older but wiser”. But Nokia recently released an Analysis Mason study of “5G Maturity” and while older companies may or may not be wiser, there is clearly a difference in the maturity of operators’ approach to the industry’s next big leap. I came to my own conclusions about how fast we would get to 5G, especially for the Latin American operators.

The webpage version of the press release (which you can find here) points to the Analysis Mason white paper on the study, the replay link for a webinar held this week and some related Nokia resources. The webinar allows one to download a set of slides that include important graphs and other information which are not in the white paper so I strongly recommend watching it or at least connecting to download the slides.

Good and bad, I define these terms quite clear, no doubt, somehow

Analysis Mason surveyed 50 operators from around the world, asking them questions which revealed their 5G-related strategies in two dimensions: Technology and Business.

Some examples of strategies that moved companies higher in the Technology dimension were earlier launch strategies, sooner expectations for reaching 75% 5G population coverage, or having already deployed NFV/SDN in one’s 4G network.

Examples of strategies that move companies higher in the Business dimension included developing a variety of use cases, transforming OSS/BSS and building an interconnected partner ecosystem in a range of vertical industries.

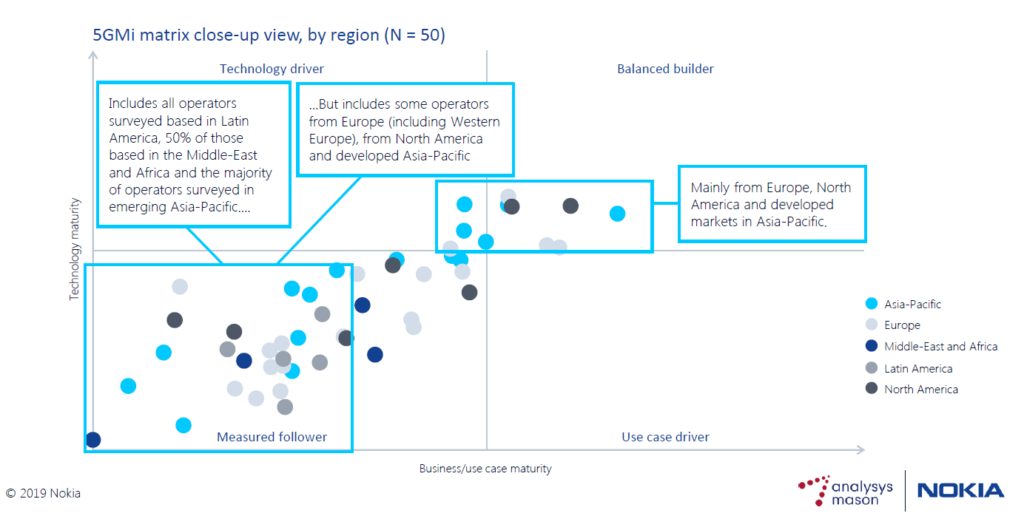

Analysis Mason with Nokia conceived of an ideal or ‘most mature’ 5G operator and from that scenario worked back to a 3×3 grid of potential maturity levels – 3 levels on the Technology dimension; 3 levels on the Business dimension. The operators in the study were then plotted (anonymously) on this grid. No operator was identified on the chart and the detailed results were not revealed to protect the innocent – or perhaps I should say, the immature.

Only 11 operators or slightly more than 20% made it out of the lower-left hand corner, the least advanced level, and there was no operator in the highest category of either dimension. The next chart – shamelessly stolen from the webinar but with full credit and (above) the link to the original material – shows the results in a format that allows the regions to be distinguished. The Latin American operators are shown in dark grey.

I do not know if the Middle East and Africa operator who barely made it away from the (0,0) point on the grid should be pitied for its poor position or congratulated for its honesty.

Using ideas as my maps / “We’ll meet on edges, soon, ” said I

Latin America is called out in the graph for having ALL of its surveyed operators in the lower-left corner of the lowest maturity category. The other regions all had some operators in other parts of the grid, even Middle East and Africa where 50% were outside the immaturity zone. These were, no doubt, the Gulf region operators where rich absolute monarchs are using their financial muscle and control over ‘trivial’ matters like site approvals to compete with each other over who gets to be first or who gets to have the best coverage in 5G.

As I said before, individual operator results are not reported but the five LA operators in the survey were:

- America Movil Mexico (#9)

- Vivo (#27)

- Telefonica Movistar Argentina (#30)

- Digicel (#31)

- Entel (#45)

(The numbers in brackets are their position in the Analysis Mason / Nokia presentation which I do not believe has anything to do with maturity level.)

Entel is usually an early adopter so it was a surprise to me when Caroline Gabriel, on of the report’s authors, was quoted telling a Buenos Aires audience recently that Mexico and Argentina were “the two countries with the best road maps towards the 5G in the region:” That suggests the two dots furthest (radially) from (0,0) should be America Movil Mexico and Telefonica Movistar Argentina (in an indeterminant order).

In any event, these regional leaders are still down deep in the lower-left corner (called “Measured follower” by the analyst team) and a long way from the more mature operators in “Balanced Builder” category.

(I tried to correlate the regionally-colored chart above with a chart colored by size of operator. The results did not make any sense in the light of Gabriel’s remarks about Mexico and Argentina. By dot color, the highest ranking Latin American company is supposed to be a Tier 1 or Tier 2 Group and the only group name in the LA list is Digicel. Digicel operates in the Caribbean basin. The only Mexico and Argentina names in the list are OpCos, supposedly in a different color. Maybe the chart legend is wrong or maybe the analyst team assumed America Movil Mexico was answering for the group. Mexico-based executives often play dual roles — staff for the group and operationally for Mexico.)

The other regional information in the webinar deck is slide 13 which shows operators’ comments about when they expect to achieve 75% population coverage and compares that to when that milestone was achieved in 4G. The analysts’ global conclusion was that companies are being conservative about their 5G deployments, at least more conservative than they were with 4G.

From a Latin America perspective, slide 13 suggests that AMX (the only Mexico operator) plans to have 75% population coverage with 5G by 2022 but the operators in Argentina (Telefonica), Brazil (Telefonica) and Chile (Entel) think it will be “Later / don’t know”.

(I am not sure how that translates into roadmap leadership for Argentina but maybe that is in the detailed results. I hope Caroline did not just get pressured by a local Argentine reporter’s look of disappointment when their homeland was not mentioned.)

My guard stood hard when abstract threats too noble to neglect / Deceived me into thinking I had something to protect

I do not think conservatism with estimates about 5G deployment are inappropriate, especially for Latin America. For one thing, with the exception of Digicel and Entel, the questionnaire was answered by an OpCo leader with limited control over 5G deployment, at least at this early stage. Group headquarters will make that decision. Furthermore, the question was “When do you think you will get to 75% coverage?” which is even harder to predict when at an early stage of planning and the use cases are not clear.

In any event, it looks like 5G will reach 75% population coverage in the region only after – probably well after – 2024.

But I think I have squeezed about as much as I can out of the limited LA data and I should confine my comments to the global data.

Like the analysts, I was surprised by the small number of use cases upon which companies were basing their deployment plans and the limited ecosystems they were building. Many were looking not much further than higher-faster-stronger enhanced mobile broadband, maybe some fixed-wireless broadband. This is not what vendors and the consultant community have been telling them. But perhaps we have been describing “abstract threats too noble to neglect” and the operators are more pragmatic.

And yet…

Last June, Telefonica held an analyst day and, as usual, CEO José María Álvarez-Pallete gave the keynote address. The theme was a Benjamin Button, the F. Scott Fitzgerald story and Brad Pitt movie about a man who is born old and every year gets younger. Álvarez-Pallete said Telefonica was born as an old-style monopoly telco but he wanted it to get younger every year, to embrace more radical business models, to transform the company’s network and operations to take advantage of the latest, the most modern, the youngest (if you will) ideas.

Looks like all operators are going to have to do that if they want to get the most out of their 5G investments.

Ah, but I was so much older then / I’m younger than that now.

Title Reference: The title and lyrics come from My Back Pages by Bob Dylan, although my guess is that the chorus (the line immediately above this note) is better known than the title. This Wikipedia article says that it was recorded in late 1964 and is considered the end of Dylan’s ‘Woodie Guthrie’ period. The next year, 1965, would bring the electric side of Bringing It All Back Home and then in July, Dylan’s electric-guitar-driven set at the Newport Folk Festival that would break his relationship with the ‘folk’ movement forever but propel him to deity-status in rock music. The song was never a hit but it is (or perhaps was) well-known in the 1960s and 70s even beyond Dylan fans. For decades, ‘baby-boomers’ (those born between 1946 and 1964) seemed to never want to grow up and Dylan’s phrase seemed to gently capture that notion; gentler at least than Pete Townsend’s “Hope I die before I get old”.

No Comments »

Leave a Reply